how much federal taxes deducted from paycheck nc

You fill out a pretend tax return and calculate that you will owe 5000 in taxes. Hourly non-exempt employees must be paid time and a.

Any wages above 147000 are exempt from.

. The act went into full effect in 2014 but before then North Carolina had a three-bracket progressive. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. In most cases your state income tax will be less if you take the larger of.

The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and. How Is Tax Deducted From Salary.

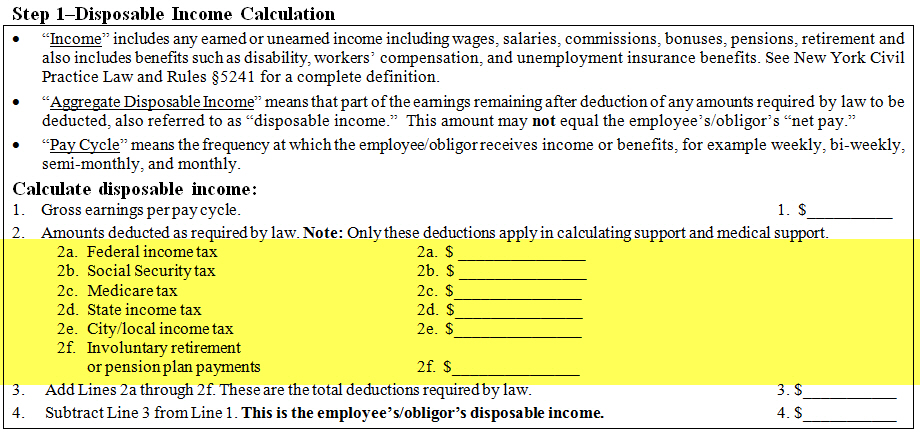

These amounts are paid by both employees and employers. The amount of taxes to be withheld is. FICA taxes consist of Social Security and Medicare taxes.

The income tax is a flat rate of 499. How It Works. The payer has to deduct an amount of tax based on the rules prescribed by the.

Minimum Wage in North Carolina in 2021. Mailing Address 1410 Mail Service Center Raleigh NC 27699-1410. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly.

North Carolina tax year starts from July 01 the year. See how your refund take-home pay or tax due are affected by withholding amount. The median household income is 52752 2017.

95-258 Withholding of Wages an employer may withhold or divert any portion of an employees wages when. Standard deduction or NC. The 10 rate applies to income from 1 to 10000 the 20 rate applies to.

95-258 a 1 - The employer is required to. You can have 10 in federal taxes withheld directly from your pension and IRA. Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year.

Use this tool to. In October 2020 the IRS released the tax brackets for 2021. Emf meter circuit thalia and nico find out percy was abused fanfiction.

For 2022 employees will pay 62 in Social Security on the. The money also grows tax-free so that you only pay income tax when you. How to calculate Federal Tax based on your Monthly Income.

You may deduct from federal adjusted gross income either the NC. Effective January 1 2020 a payer must deduct and withhold North Carolina income tax from the non-wage compensation paid to a payee. However making pre-tax contributions will also decrease the amount of your pay that is subject to income tax.

State Tax is the tax mentioned to the cousin in the text. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly. North Carolina has not always had a flat income tax rate though.

Considering this How much taxes do I pay on 5000. No state-level payroll tax. That is a 10 rate.

Estimate your federal income tax withholding. Physical Address 3514 Bush Street Raleigh NC 27609 Map It. It is 525 and must be paid by any resident or non-resident who generates money in the USA.

Pay Your North Carolina Small Business Taxes Zenbusiness Inc

Taxable Wage Definition For Social Security Taxes

Salary Paycheck Calculator Calculate Net Income Adp

Free Online Paycheck Calculator Calculate Take Home Pay 2022

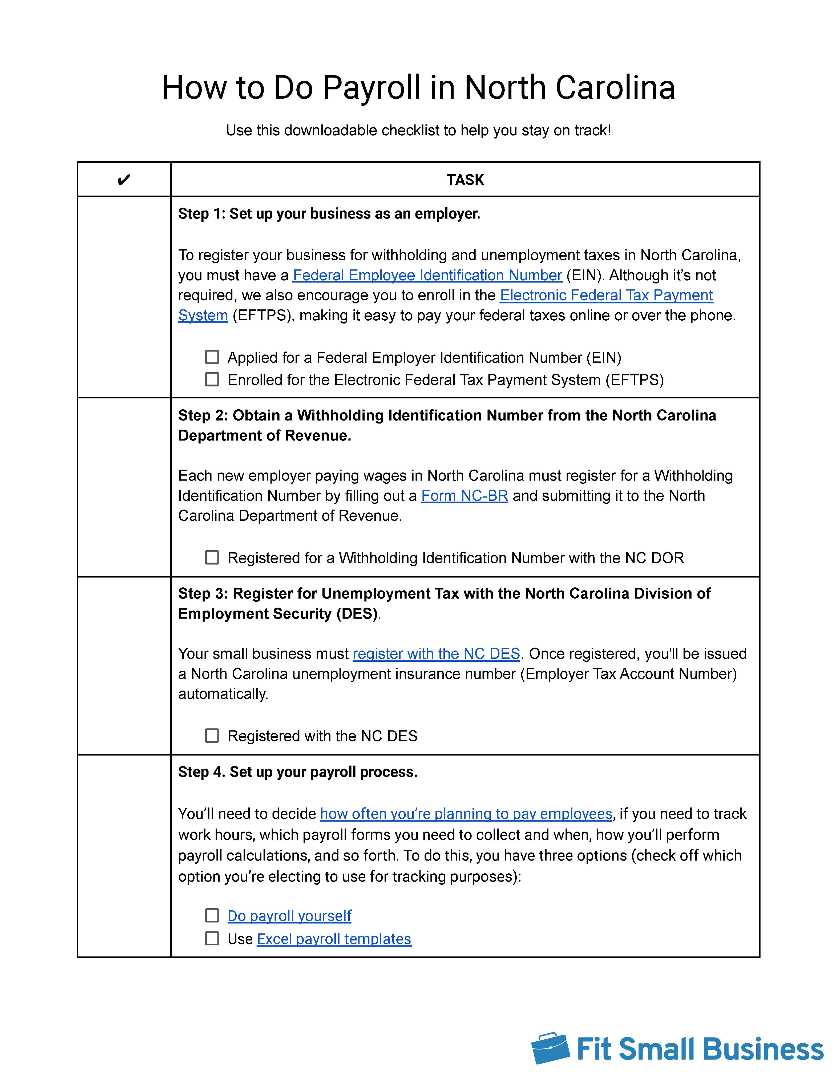

How To Do Payroll In North Carolina Detailed Guide For Employers

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

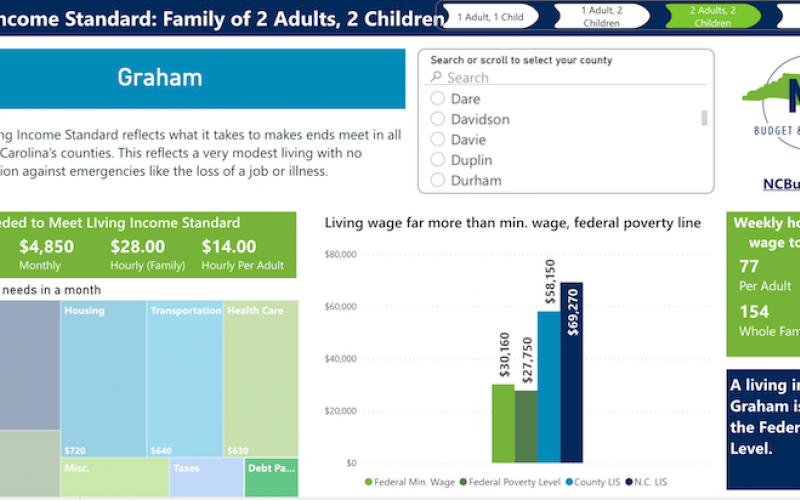

Earning A Living In Graham County The Graham Star Robbinsville North Carolina

Individual Income Taxes Urban Institute

North Carolina Restaurant Adding 20 Fair Wage Service Fee To Every Bill Wric Abc 8news

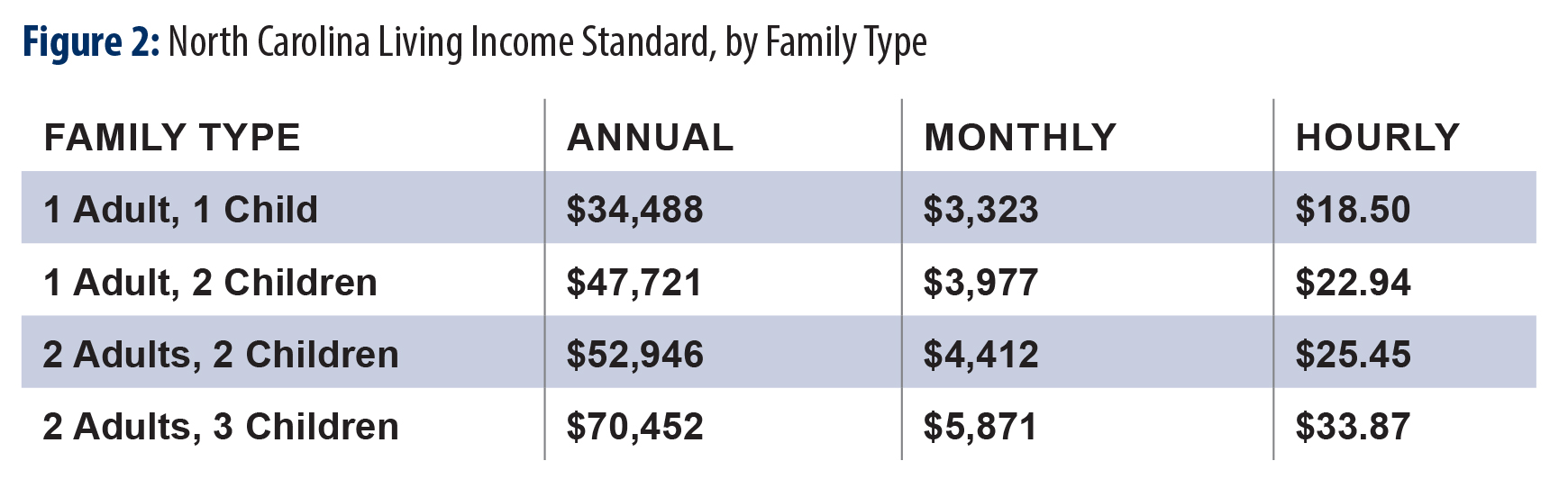

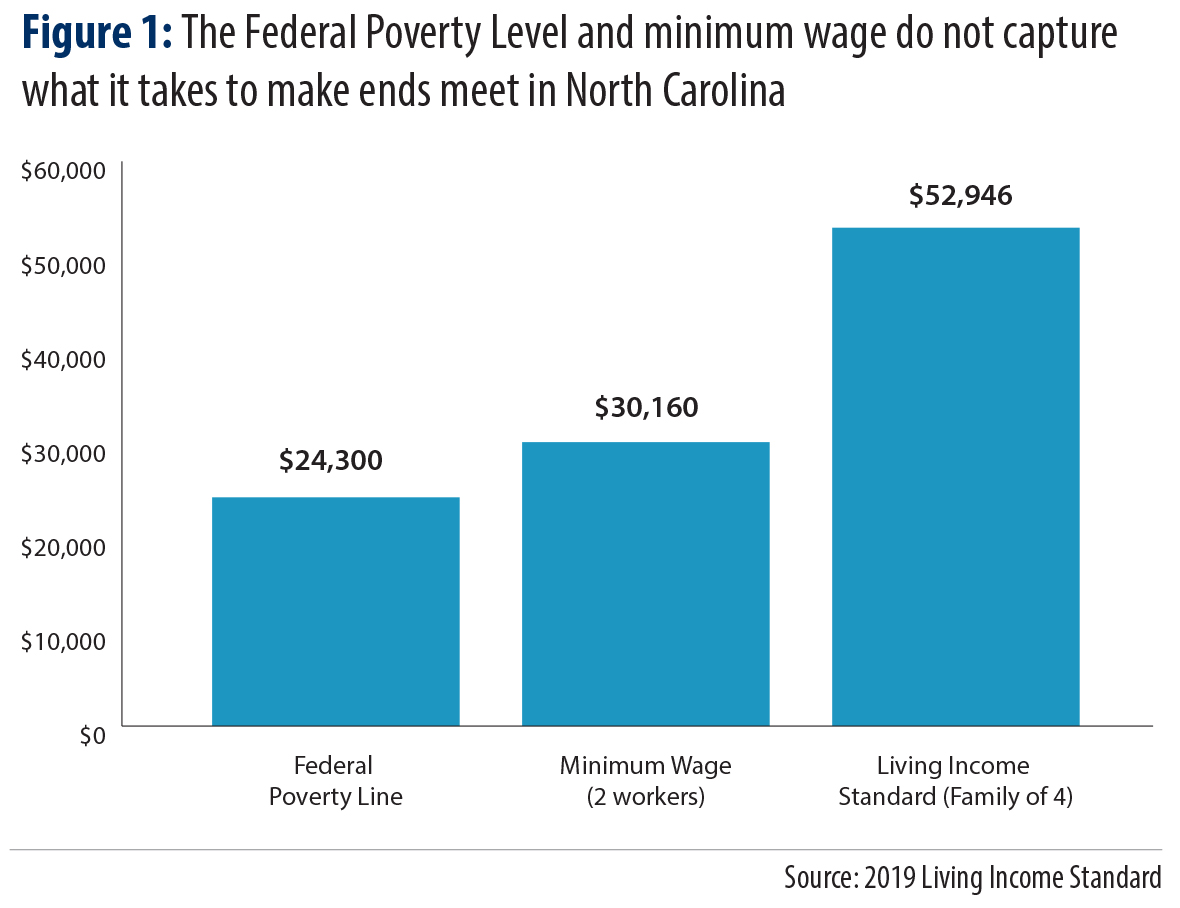

The 2019 Living Income Standard For 100 Counties North Carolina Justice Center

How To Calculate North Carolina Income Tax Withholdings

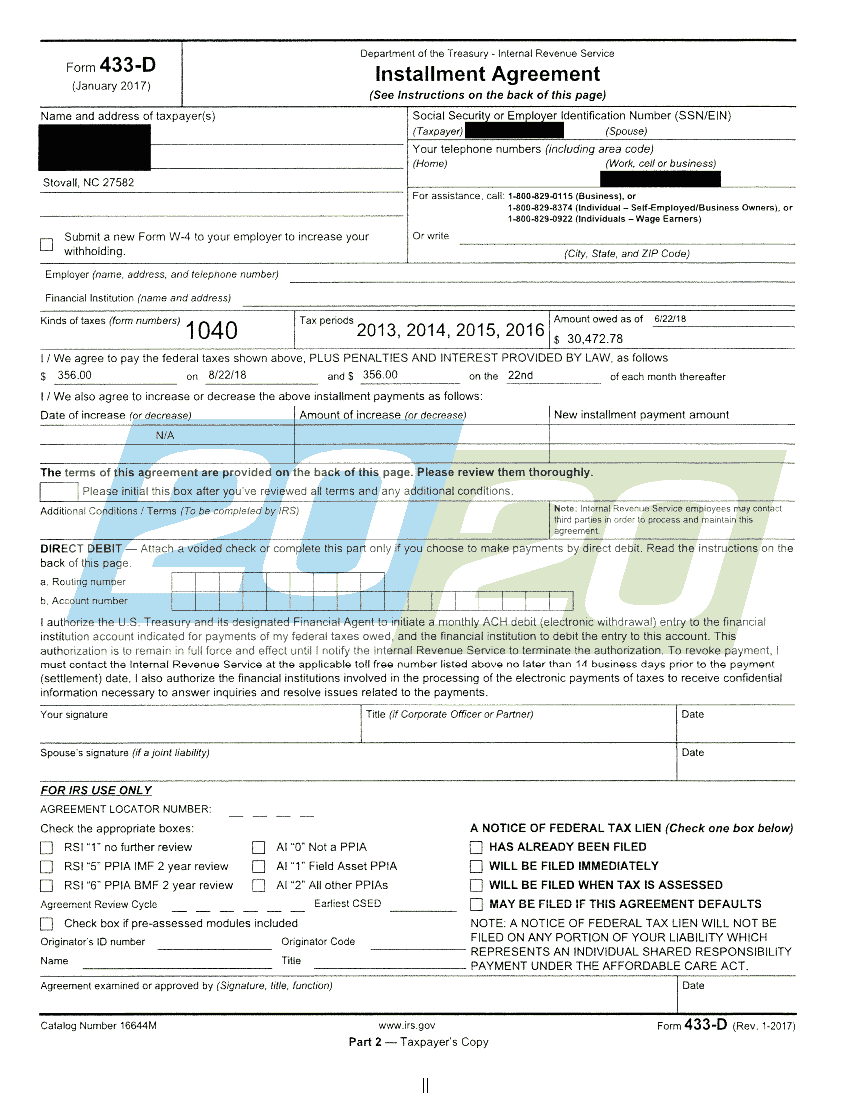

Irs Accepts Installment Agreement In Stovall Nc 20 20 Tax Resolution

How Many Tax Allowances Should I Claim Community Tax

North Carolina Income Tax Calculator Smartasset

The 2019 Living Income Standard For 100 Counties North Carolina Justice Center

North Carolina Paycheck Calculator Smartasset

N C Property Tax Relief Helping Families Without Harming Communities North Carolina Justice Center